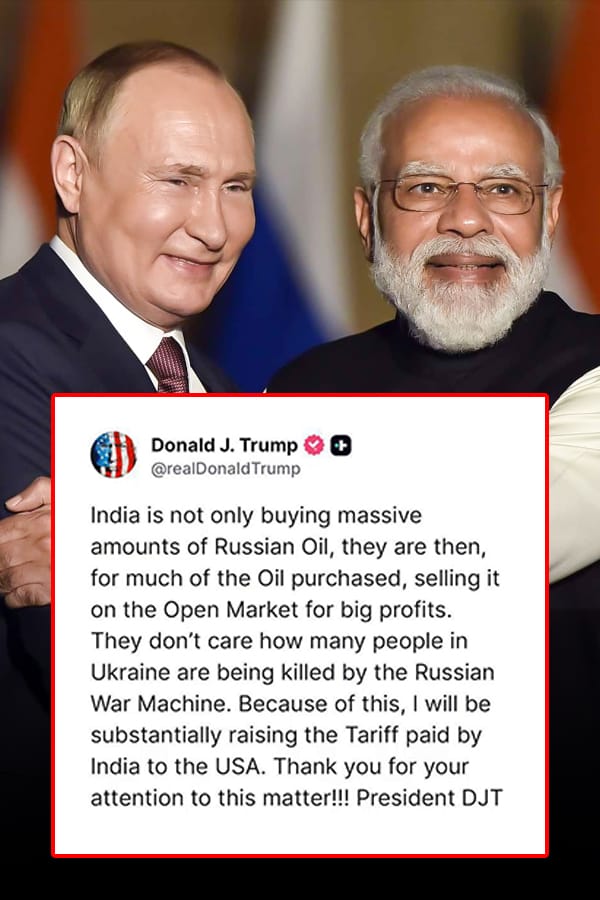

America looks keen on halting India’s imports of Russian oil.

12th September

Impact of US Ambassador Nominee's Call to End Russian Oil Imports on Indian Markets

In a high-profile Senate hearing on September 11, 2025, Sergio Gor, Donald Trump’s nominee for U.S. ambassador to India, made it crystal clear that India must stop buying Russian oil to unlock stronger economic ties with the United States. This firm position has significant implications for India’s oil imports, refining industry, and the stock market.

Current Import Data: Russia vs. USA

Russian Oil Imports in 2025

India imports approximately 2.0 million barrels per day of Russian crude (August 2025), up sharply from 1.6 million barrels in July.

This accounts for 38% of India’s total crude oil imports, representing a 1,600% increase from pre-2022 levels when Russian oil imports were negligible.

The monthly value of these imports is approximately $4-5 billion, discounted by $1.5-$3 per barrel compared to global benchmark prices.

Russia peaked as the top oil supplier in 2023, with 2.15 million barrels per day, around 45% share, and continues strong through 2025 despite political pressure.

US Oil Imports in 2025

India imported an average of 271,000 barrels per day of crude oil from the US in the first half of 2025, up from 3% of import share in 2024 to 8% currently.

The value of US crude imports surged to $3.7 billion in Q1 FY26 from $1.73 billion in Q1 FY25, marking a 114% year-over-year growth.

The US-India oil trade has decades-long roots but saw significant growth only recently, correlating with geopolitical factors and diplomatic efforts.

Key Indian Refining Companies & Market Exposure

Major Russian Crude Processors

Reliance Industries (RIL) is India’s largest Russian crude importer, processing 664,000 barrels per day (~50% of their crude intake), with a stock price around ₹1,383 but recently down 7% in 30 days due to sanctions concerns.

Indian Oil Corporation (IOC) processes 341,000 barrels per day (24% of imports) with a stock price of ₹144 and a 5-year return of +175%, benefiting substantially from Russian crude discounts.

Other refiners like Nayara Energy, Bharat Petroleum (BPCL), and Hindustan Petroleum (HPCL) also hold significant Russian crude exposure with notable stock market presence.

Market Performance: Before vs. After Russian Imports

Pre-Russian Imports Era (2019-2021)

Traditional Middle Eastern suppliers (Iraq, Saudi Arabia, UAE) dominated the Indian crude landscape, constituting over 80% of imports.

Russian crude imports were <1%.

Refining margins were standard with relatively higher crude costs.

Stock valuations in the oil sector were lower compared to the current period.

Post-Russian Imports Era (2022-2025)

Russia emerged as the number one supplier at 38% of total crude imports.

Traditional suppliers saw minor decreases, indicating a diversification shift.

Indian refiners saved an estimated $12.6 billion over 39 months due to discounted Russian crude.

Stock performance surged with IOC gaining 175% and RIL posting 98.6% growth over five years.

Refining margins improved by $1.5-3/barrel, boosting profitability.

Potential Market Impact If Russian Imports Are Halted

Immediate Financial Impacts

Expected gross refining margins (GRM) reduction by $1-1.5 per barrel across all refiners.

EBITDA impact projected at 8-10% negative for state-owned refiners and about 2% for Reliance Industries.

Potential increase in India’s oil import bill by over $2.5 billion annually.

Replacement crude oil (likely from the US) typically costs $5-$10 more per barrel, squeezing refining margins further.

Stock Market Implications

Forecasted 5-15% downside risk for oil refining stocks due to margin compression and uncertainty.

Most vulnerable companies include HPCL, BPCL, and IOC given their higher Russian crude exposure.

Reliance has already shown recent weakness reflecting sanctions fears.

Supply Security Challenges

India would need to replace approximately 2 million barrels per day of Russian crude.

Current US oil supply to India is only about 271,000 barrels per day, requiring a 7x increase to fully replace Russian volumes.

Alternative suppliers from the Middle East have limited spare capacity.

The transition is expected to take 6-12 months to arrange new contracts and supply chains.

Market Outlook & Strategic Implications

The potential cessation of Russian oil imports is a double-edged sword. While it may enhance U.S.-India trade relations and geopolitical alignment, it poses short- to medium-term risks of earnings reduction and market volatility in the Indian oil and gas sector.

Key risks include:

Compression of refining sector earnings due to higher crude acquisition costs.

Inflationary pressures from increased energy import bills impacting the broader economy.

Volatility in oil and gas related stock prices.

Increased foreign exchange demand due to higher dollar outflows for oil imports.

The adjustment period of 6-12 months will be critical as Indian refiners navigate contract re-negotiations, cost absorption, and supply chain re-alignments, all influencing market sentiment and sector performance.